Navigating the Great Reversal: How Debt Burden is Affecting Health

Author:

George Njenga Kiai

Article Type:Article Number: 6

The global economy is experiencing a profound transformation, a "Great Reversal," characterized by shifts towards protectionism, changes in labor dynamics, and technological advancements. This article examines the debt crisis and its implications for health by using insights from the World Bank Report entitled “The Great Reversal”, the World Bank Spring meetings 2024 and the World Bank IDA21 report as well as a United Nations report and other sources.

Introduction

The global economy is undergoing significant transformations, marked by what has been termed as the “Great Reversal.” At its heart is the debt crisis that has reversed decades of development. We delve into historical trends, current data, and future projections from various reports to provide a bird’s eye view on the why and how of the debt crisis in countries, which are receiving support from the World Bank, and plans of the World Bank to mitigate its impact on health.

Historical Context

Economic trends have always reflected the technological and geopolitical environment of their times. In 1944, the Bretton Woods system (taking the name of the venue in USA that hosted a United Nations conference), which linked the U.S. dollar value to the price of gold, shaped international monetary policies in the post-World War II years, leading to stable exchange rates and fostering international trade. In its wake followed the founding of the International Monetary Fund (IMF) and the International Bank for Reconstruction and Development (IBRD) and the World Bank, which became operational in 1946. By the 1960s, however, the system was seen as overvaluing the U.S. currency rate against gold and collapsed by the 1970s allowing currencies to free float rather than be pegged to a fixed valuation. It is in this period of the mid-1970s that poor countries began facing the pinch of the balance of payments and led to the first instance of international concessional funding by the IMF to these countries through a Trust Fund that took additional and different forms over the next decades. The 1980s and 1990s saw the rise of neoliberal policies, emphasizing deregulation, privatization, and free-market capitalism.

The 2000s brought about a digital revolution, further integrating global markets and accelerating trade and investment flows. However, recent years have witnessed a significant shift in these trends, characterized by increasing protectionism, trade wars, and a re-evaluation of global supply chains. There is also a widening digital divide.

The Debt Crisis

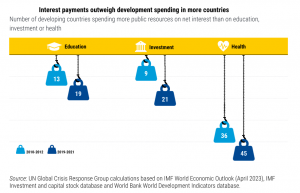

As per the World Bank’s The Great Reversal: Prospects, Risks, and Policies in International Development Association Countries, (hereinafter referred to as World Bank report), the post-COVID-19 pandemic decade has seen the steepest and most synchronized monetary policy tightening in recent decades leading to higher global interest rates. So, the debt incurred by countries, which are taken on the condition of repayment in foreign currency denomination drives up the cost of servicing that debt; and hikes up interest rates. This, according to a United Nations report on the “A world of debt. A growing burden to global prosperity” leads to diversion of national investments towards repaying that interest and debt and away from imperatives of health and education (Figure 1).

Figure 1

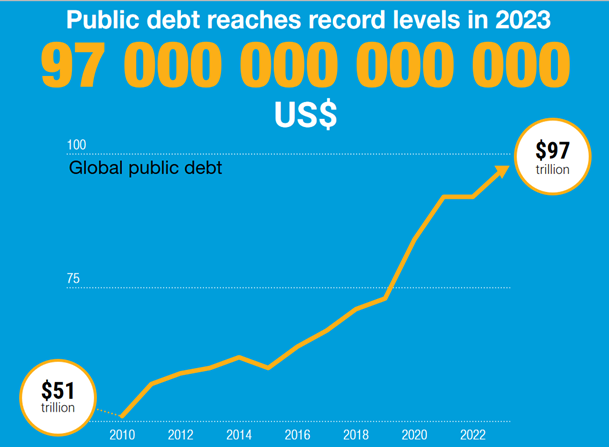

According to the above-mentioned United Nations report, the rise in global public debt (Figure 2) is unprecedented in history with 59 countries caught up in its swell in 2022 as compared to 22 in 2011. Moreover, 30% of the galloping public debt is owed solely by developing countries.

Figure 2

World Bank and the International Development Association

The World Bank’s International Development Association (IDA) grants low-interest loans and grants to 75 countries, which comprise the majority (over 70%) of the extreme poor across the globe and which account for a mere 3% of the world’s output. As per the World Bank report, one in three IDA countries is poorer now than on the eve of the pandemic. The number of people in IDA countries facing hunger and malnutrition is double what it was in 2019, and now accounts for 92% of the world’s population who face food insecurity. Half of IDA countries are in debt distress or at high risk of it. Many IDA countries’ financing needs outstrip their Gross Domestic Product by 10 per cent. These countries include a majority from Africa: Burundi, The Gambia, Ghana, Kenya, Malawi, Mozambique, Togo, Zambia; and Asia-Pacific: Pakistan and Fiji.

The rounds of the twenty-first replenishment of the International Development Association (IDA21) are underway. According to the World Bank’s IDA21 report IDA21 Replenishment: Proposed Strategic Direction, multiple crises have reversed decades of development progress, exacerbating poverty and inequality, disrupting supply chains, and increasing food insecurity. It has led to the World Bank increasing its commitment to countries, which are the most vulnerable, with provisioning of a whopping $34.2 billion in low-cost financing and grants between July 2022 and June 2023 alone.

Health Implications and Initiatives

One of the critical intersections between economic trends and broader societal impact is the area of health. The recent World Bank Spring Meetings 2024 highlighted ambitious goals to expand health services globally, with a target to support countries in delivering quality, affordable health services to 1.5 billion people (World Bank). This initiative includes widening the focus from maternal and child health to comprehensive care throughout a person’s life, addressing remote and underserved areas, and reducing financial barriers to access as around 2 billion people contend with significant financial stress in paying for health services. However, only a person who is attended to by a health-care worker via an in-person visit or telehealth will be counted towards this goal. And the World Bank has acknowledged that by 2030 there will be an unmet need for 10 million health-care workers.

IDA21’s focus on building health system resilience is critical in addressing threats from climate change, pandemics, and conflicts. Investments in Universal Health Coverage and quality health and nutrition services aim to reach even the most remote communities, ensuring robust health outcomes across IDA countries. The plan is for IDA to finance sending health workers to communities most in need while the International Bank for Reconstruction and Development will provide incentives to government for its investments in health and regulations for country advancement.

Impact of Electricity Access on Health

Access to electricity is another vital factor influencing health outcomes. The World Bank’s commitment to providing 250 million people in Africa with electricity access by the end of the decade is expected to have profound health implications (World Bank). Reliable electricity can improve health care delivery, enable the use of modern medical equipment, and ensure the availability of essential services such as refrigeration for vaccines and other medical supplies.

Future Projections

As pointed out by the World Bank report, the recovery of IDA countries depends also on the major economies registering their own growth as well. But even the projected growth in Gross Domestic Product (GDP) – often used as a measure of economic progress and now being challenged – in IDA countries (3.7% in 2023 to 4.3% in 2024 and 4.5% in 2025) will barely dent poverty. There are also many assumptions for the fulfilment of this projection, that security challenges remain within control; that there will be no escalation of conflicts in other countries, that natural disasters do not reach epic proportions; and that debt crises do not arise anew. That’s a lot of assumptions. The escalation of conflict in the Sahel region in Africa, for instance, which is already facing climate change vulnerability from desertification (rise in aridity of land), threatens development progress and undermines growth. The likelihood of oil-producing countries getting more embroiled in the war in the Middle East region, apart from the war already raging in Ukraine due to Russia’s invasion, would cause further disruptions in oil supply. This is turn would push up fuel and food prices and further jeopardize food security and health of people living on the margins in IDA countries.

Conclusion

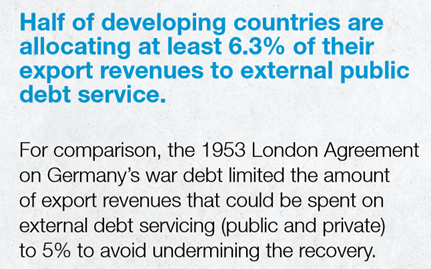

Since we began with a historical overview from the 1940s, let us return to that time with the timely historical reminder in the United Nations report.

And the recovery of IDA countries is being seriously jeopardized as per the World Bank report with 76% of IDA countries as of 2023 already submerged under dual fiscal account deficit, i.e. the shortfall in income versus spending; and current account deficit, i.e. importing more than exporting of good and services, which means it’s taking in more than what it is producing and paring down its savings or dipping into its foreign currency reserves. With IDA countries already grappling with such a huge mountain of debt, any increase in the global interest rates would spiral into spiking inflation, heighten the costs of servicing foreign-currency-linked debt, and negatively affect national developmental indices. It is to be noted that IDA countries did show improvement on indicators of basic services, poverty reduction and life expectancy, but they now face the threat of a looming lost decade of developmental goals as their debt balloons.

There have been calls for the IMF and WB to write off the debt of Africa. This was done in 2005 when rich nations under what was then called Group of Eight (G8) offered to write off $40 billion in debt to multilateral institutions that included the IMF, World Bank and the African Development Bank. Fourteen of the countries owing that debt were from Africa.

A World Bank report citing research stated that, “Debt restructuring and relief processes, particularly the G20 Common Framework, require improvements to address today’s sovereign-debt challenges: they have been too slow in delivering debt relief, and ill-equipped to manage the much more diverse landscape of private and official creditors today.” This tardiness is inexcusable given that the group of 20 dubbed G20 include 19 countries, the European Union and the African Union, is primarily tasked with working on major issues facing the global economy.

India assumed the presidency of the G20 in 2023, Brazil in 2024, and with South Africa slated to take over and host the G20 summit in 2025, these nations continue to be active in raising the voice of the Global South in such fora. In 2023, a G20 Joint Finance-Health Minister Meeting was held in India where they committed to continue strengthening the dialogue through the G20 Joint-Finance-Health Task Force to “mitigate economic vulnerabilities and risks from pandemics”. The outcomes of the G20 is hoped to be taken forward at a summit of the G7 (G8 without Russia), where India, Algeria, Brazil, Egypt, Kenya, Mauritania, South Africa, Tunisia and Türkiye along with Saudi Arabia have been invited to an outreach session with a focus on Africa, the Mediterranean and other issues crucial to the Global South.

Individual countries are also stepping up to do their bit. Japan has pledged to enhance health and finance ministries’ capacity through the initiation of a Universal Health Coverage Knowledge Hub, supported by the World Bank and the World Health Organization.

Innovative funding mechanisms such as Debt2Health (D2H) the Global Fund’s debt swap program, has creditor nations forego repayment of a loan if the debtor nation invests all or part of the freed-up resources into a Global Fund-supported program, aligning with the National Health Strategy. Other debt swap examples include debt-for-climate deals where a debtor country agrees on a specific green initiative in return for the debt to be foregone. Then there is blended finance, which combines grants with investments of multilateral development banks and other development finance institutions in select countries so as to help encourage new financing for health or influence existing health-related financing and lending. Read more about these mechanisms and international cooperation amidst the global crises in this issue of GFO.

The World Bank Group’s recent innovative financial instruments have been designed to expand its risk-taking appetite for shared global challenges and 11 countries (Belgium, Denmark, France, Germany, Japan, Latvia, the Netherlands, Norway, United Kingdom and USA) have pitched in a total of $11 billion. Great expectations are pinned on the remaining rounds of IDA21. The path forward requires adaptive policies, continuous investment in human capital, and a balanced approach to globalization and self-reliance so as to prevent isolationist tendencies so as to build a more resilient and inclusive socio-economic future.